Sage 50 Bank Reconciliation Unresolved Amount

Home » Sage 50 » Sage 50 Bank Reconciliation Unresolved Amount

Table of Contents

ToggleUnresolved Amount In Sage 50

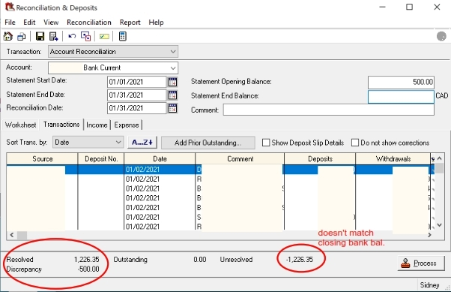

Solving Sage 50 bank reconciliation unresolved amount mystery seems difficult if you have incomplete guidance on it. It is a general problem found in Sage 50 that the majority of users suffer from. If you have verified missing entries and still there occurs unresolved amount in the bank reconciliation journals then you need to match the accounts appearing in the bank statement with the opening balance statement. This article is rounded up with relevant information on Sage 50 bank reconciliation unresolved amount.

Why Unresolved Amount Issue Come Reconcile Sage 50

The main objective of bank reconciliation is to verify the account-related data entered in the bank statements. Thus whenever there occurs any discrepancy issue or receive any un-resolved amount then you need proper investigation on the same. You can then reach out with Sage 50 support.

How to Sage 50 Bank Reconciliation Unresolved Amount

Step-by-step resolutions to quickly fix Bank reconciliation unresolved amount:

Step1-Verify Relevant Elements

Here are the things that need to open and check:

- Check you have written correct entries like Statement Start Date, End Date, Opening Balance, and Ending Balance

- Verify the date mentioned in statements

- Check all the transactions are properly recorded in Sage 50

- Monitor, you have cleared the transactions that display in your bank statement

- Check the balance and entered bank fees displaying in the Expense option

- Ensure you have integrated gains like exchange, interest, and errors in the option which says Income

- Make sure that the outstanding amount must match with the sum of all the unchecked items listed on the Reconciliation page.

ReConcileBooks also gives extended details How To Reconcile Credit Card In Sage 50 step by step.

Step 2-Check Discrepancy

The formula for solving Discrepancy includes the opening book balance minus the sum of statement opening balance and opening outstanding balance. Follow the below instructions:

- If you want to check the value for the opening outstanding then you have to check the existing outstanding at the finale of reconciliation

- View the balance appears on the beginning line located on the top which is called opening balance

- Hit on OK

- Choose the account

- Apply the start & finish dates matching with bank reconciliation date

- Click on Reports, General ledger, or Reports.

Sage 50 Value Of Discrepancy Is Negative

This signifies that the opening book balance is lower than the total of statement opening balance and outstanding.

Need Expert Help: Are you getting Sage 50 Bank Reconciliation Unresolved Amount and don’t know how to solve it? In that case, you must get immediate help from our Sage 50 experts by dialing the ReConcileBooks helpline number at any time.

In this case, there might occur following three possibilities:

- Extreme high opening outstanding

- Very low opening bank balance

- Too high statement opening balance

Sage 50 Value Of Discrepancy Is Positive

It represents that the opening book balance is higher than the total of opening outstanding + statement opening balance. There also occur three conditions i.e. too high opening balance, low opening outstanding and low statement opening balance.

Step 3-Verify the Unresolved Amount

- If you found unresolved that’s mean it is the sum of statement end balance and ending outstanding minus the ending book balance amount

- The ending outstanding represents the outstanding amount you can view on the base of the bank reconciliation window

- Ending book balance: To search the value you need to follow the steps:

- Locate Reports, Financial and afterword General ledger

- Adjust the Start and ending dates similar as written to the bank reconciliation dates

- Choose the amount

- Hit on Ok

- You can view the balance located on the bottom

- Perform the comparison test if there found any content corrupted in the bank reconciliation. Following is the test:

- Check the ending book balance is equal to the sum of ending balance and outstanding balance. If not found same then that difference occurs between them is known as the unresolved amount

- If the amount seems the same and there still exists a discrepancy amount that means the bank reconciliation table consists of corrupted data and there is a need to reset the same.

- Now if you face unresolved, then you can switch into the next duration through receiving an auto-generated journal entry.

- This option is not suggested through Sage because of future complications

- Resolve the found unresolved values i.e. either negative or positive unresolved.

Negative Balance Sage 50 Reconciliation

Following are the major reasons behind negative and positive unresolved amount:

- High ending balance:

- It is due to several debit entries, missing credit entries, matching withdraw field is not checked,

- Need modification on the voided credit transaction and more.

- Low ending balance:

- Missing outstanding Cheques like journal revenue cheque

- The amount is incorrect

- Wrong posted dates

- The end date is not correct

- Low Statement ending balance:

- This is a bank-related issue

- Data entries mistakes

- Duplicate entries

- Date mismatches

- The wrong filled ending balance amount in reconciliation window

- The end date of the invoice is wrong

Check the above-given possibilities and then set the proper adjustments if found the core of the issue.

Follow the below instructions:

- Do the adjustments during the bank reconciliation period

- Once done adjustment then you have to reset bank reconciliation

- Check, you have clear the credit receipt if not clear it

Help Unresolved Amount Problem Sage 50 Pro, Premium , Quantum

Hope the above article gave you clarity on the Sage 50 bank reconciliation unresolved amount and bring you a step closer to begin troubleshooting. If you face any difficulty to understand any step mentioned in the topic or need any other assistance then reach the +1347-967-4079 ReConcileBooks telephone number. Apart from this topic, you can also explore knowledge on the other components of Sage 50 including reconciliation of invoices, amount, and more. You can mail your queries or do a Sage 50 Live Chat with the expertise for instant assistance.

Frequently Asked Questions

Q. What is Sage 50 Bank Reconciliation?

Ans. Sage 50 Bank Reconciliation is a feature of Sage 50 accounting software that helps you match your bank transactions with those recorded in your accounting records to ensure accuracy.

Q. What is an Unresolved Amount in Sage 50 Bank Reconciliation?

Ans. An unresolved amount is a difference between the bank statement balance and the Sage 50 account balance that cannot be accounted for by any of the reconciled transactions. It represents a potential error or discrepancy in the accounting records.

Q. How Do I Find the Unresolved Amount in Sage 50 Bank Reconciliation?

Ans. The unresolved amount is usually displayed on the Bank Reconciliation screen in Sage 50. If it is not displayed, you can calculate it manually by subtracting the Sage 50 account balance from the bank statement balance.

Report your Issue

Latest QuickBooks Topic

- QuickBooks Desktop 2024 Download, Features and Pricing

- Traverse to QuickBooks Data Migration

- Microsoft Access to QuickBooks Data Migration

- How to Fix QuickBooks Payroll Update Error 15243?

- How to Fix QuickBooks Error Code 12057?

- Maxwell to QuickBooks Data Migration

- Master Builder to QuickBooks Data Migration

- How to Fix QuickBooks Error Code 15223?

Accounting Issue and Problem

- SAGE 50 2022 Canada Download

- Installing SAGE 50 on Windows 11

- QuickBooks Payroll Item List Does Not Appear

- QuickBooks Firewall Blocking

- How to Email QuickBooks File

- Why QuickBooks Slow

- Why QuickBooks Freezing

- QBWC1085

- QuickBooks Scan Manager

- QuickBooks Payroll Liabilities Not Showing

- QuickBooks Unable to Send Emails Due to Network Connection Failure

- QuickBooks Utility Application

- QuickBooks Unable to Save

- How to UnFreeze QuickBooks

Search by Categories