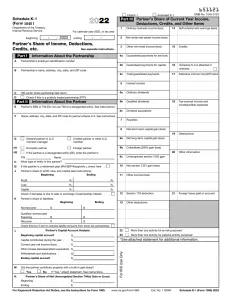

When you receive a Schedule K-1 form, you won’t have to worry where to put the information it contains. The K-1 essentially outlines, line by line, where each number from the form goes on each section of your 1040. You file your personal taxes with the Federal Revenue Service using Report K1 Income on Form 1040. You can find out from the K-1 if you need to submit any other forms together with your 1040. To achieve complete compliance with the IRS, it is essential to adhere to the 1040 K-1 requirements.

Let’s understand more about where to report k1 income on 1040.

Where Do I Report k1 Income on Form 1040?

Schedule D of Form 1040 contains information on a partner’s share of a partnership’s gains or losses. The Schedule D attachment to Form 1040. It enables a partner to disclose capital gains or losses.

Prerequisites for Claiming and Additional K-1 Information

It is difficult to discuss Schedule K-1 Form 1040 requirements in depth. The fact that K-1s are financial reports distributed by pass-through corporations should not be overlooked. These entities may be partnerships, S companies, trusts, or estates. With pass-throughs, the IRS doesn’t perceive a distinction between the corporation and you because the financial results are sent directly to your personal income tax form. This is beneficial since there are situations when you can use the financial outcomes to reduce your overall tax burden.

If you have any specific query, also get in touch with the experts of live chat.

Schedule K-1 forms fall into two categories. The financial results of the entire entity are reported in one category that is sent by the company, estate, or trust to the IRS. A different type of K-1 reports only your portion of the financial outcomes and is sent by the company, estate, or trust to you. This is due to the possibility that you only own a portion of the company or only receive a portion of the payments or distributions from an estate or trust.

Eliminating Opportunities and Income Reporting

On Form 1041, the United States Income File Tax Return for Estates and Trusts, the trust is in charge of disclosing the revenue it earns. A Schedule K-1 listing all distributions made must be given to beneficiaries by estates and trusts. On their personal income tax forms, beneficiaries then disclose these disbursements as income. The possessions of a deceased individual that are not yet given to the heirs are referred to as the estate. An asset, or group of assets, that is handled by someone other than the beneficiary is called a trust. Trusts can distribute money to the beneficiary or do other actions, such as holding onto the money until the recipient reaches a specified age.

S Corporations and Partnerships Must Comply with Reporting Requirements

Contrary to Schedule K1 1040, the Schedule K-1 that comes from a S corporation to you is Form 1120-S. Form 1065B is utilised by partnerships. Statements of income, spending, deductions, and credits are included in both formats. Dividends go on lines 9a and 9b, interest income goes on line 8a, and so on, according to the K-1 that the corporation sends you. The findings of any additional forms you must submit will likely be reported on Form E, Supplementary Income and Loss, Part II.

Why Do you have to File a Schedule K-1?

Schedule K-1 must be submitted by all partnerships. A partnership is a type of business organization in which two or more people manage a company together. According to the IRS, each person contributes expertise, labour, property, or money and shares in the business’s gains and losses.

Each partner reports their portion of the company’s gains or losses on their personal income tax return (Form 1040) and pays the appropriate amount of tax. The partners pay taxes individually rather than via the partnership as a whole.

Nonetheless, the partnership is still required to submit a Form 1065 information return to disclose the combined income, deductions, losses, and gains of the businesses. Each partner must be anticipated in advance.

Suggested Reading: Complete Guide to IRS Form 8995

Partnerships Include:

- For the purposes of the federal income tax, Limited Liability Companies (LLCs) are categorised as partnerships.

- Domestic partnerships

- Foreign partnerships receiving money from the United States or through activities related to conducting business or trading in the United States.

What Does a K-1 Show?

When two or more people manage a business or trade as a partnership, Schedule K-1 details each partner’s portion of the gains and losses.

The following details are shown explicitly on Schedule K-1:

- Name, address, identifying number, such as a social security number, and items pertaining to the distributive share of the partner filling out the K-1.

- Name, address, and partnership number are details regarding the partnership.

- Liabilities shared by the partner.

- The percentage of capital at the start and conclusion of the tax year that belongs to the partner.

- The partner’s donated properties and any resulting benefit or loss.

Conclusion

Well, a partner’s share of the business’s income, deductions, credits, and other information is detailed on a Schedule K-1 (Form 1065) tax form. A partnership business structure requires a minimum of two partners. Each partner submits a copy of this schedule to the Internal Revenue Service (IRS). Hopefully, the above information will be helpful for you in Report K-1 Income on Form 1040. For more enquiries, you can connect with professionals using Customer Helpdesk.

A Frequently Asked Questions

Q. What is the K-1 Tax Form Deadline?

Ans. Annual payment is required for Schedule K-1. Each tax year, it must be paid by the 15th day of the third month.

For example: The deadline for Schedule K-1 (encompassing 2019) would be March 15, 2020, if a partnership uses the calendar year.

The deadline will be the following business day if it falls on a Saturday, Sunday, or a legal holiday.

Q. Is it Required a K-1 for LLC?

Ans. Schedule K-1 is only required for LLCs that are categorized as partnerships for federal income tax purposes. Unless a domestic LLC submits Form 8832 and requests to be taxed as a corporation instead, the IRS automatically classifies domestic LLCs with two members or more as partnerships.

Unless the owner also files Form 8832, the IRS will automatically treat an LLC with a single member as being separate from the owner. Schedule K-1 is not required for single-member LLCs in any scenario.

Suggested Reading: Can I Cancel My 401k and Get My Money

Q. What Exactly is Schedule K-1 Tax Form?

Ans. To report a partner’s portion of a business’s income, credits, deductions, etc., utilize a Schedule K-1 Tax Form. The company must be organized as a partnership. Unless required by the IRS, it is not filed with a partner’s tax return.

The partner may be required to record their portion of the partnership income on their individual tax return in order to pay tax on it. Any losses or deductions from the company can be claimed by a partner on their tax return, although there may be restrictions on how much can be claimed.