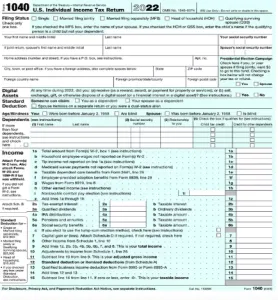

An IRS payment plan is a deal you create with the organisation to pay your federal tax bill over a specified period of time. Long-term and short-term payment plans are both available IRS payment plan for 1040 tax return. What you owe and how quickly you can pay it off will determine which one is best for you.

You’ll pay your debt through a monthly payment plan with the IRS. The organisation typically won’t impose a tax levy or a tax lien as long as you’re complying with that. It’s important to note that enrolling in an IRS payment plan does not exempt you from paying interest and penalties for late payments. They keep adding up until your balance is zero.

Who and all are Eligible for an IRS Payment Plan for 1040 Tax Return?

Everyone who owes $10,000 or less will be qualified for an installment arrangement, according to the IRS, if they also:

- Can substantiate their inability to pay the current tax due.

- Are capable of finishing the three-year tax debt payment in full.

- Have completed their tax refund IRS on time and paid all outstanding taxes over the past five years.

If you match the requirements listed below, you can also submit an online application for a short- or long-term plan.

- Long-term payment plan: You may require more than six months (180 days) to pay your tax bill if you owe $50,000 or less in total tax, penalties, and interest. You have also submitted all of your tax forms.

- Short-term payment plan: You have filed all of your tax returns, you owe less than $100,000 in total tax, penalties, and interest, and you can pay off your tax debt in six months (180 days) or less.

Procedure to Apply for an IRS Payment Plan

Applying for an IRS payment plan is possible online, by mail, or over the phone. The quickest way to apply whether you are eligible for a short- or long-term payment plan is online through the IRS’ payment plan application page.

You can also complete IRS Form 9465 and mail it to the IRS. To apply via phone, you can also call the IRS’s main hotline.

How to Apply for an IRS Payment Plan Offline?

On the IRS website, you can submit an application for a payment plan. Use the same user ID and password to sign in if you previously created an IRS online account to request a tax transcript or an identity protection PIN.

If not, you’ll need to register for an ID.me account, which calls for having the following details on hand:

- Access to your email and a working email account.

- Picture IDs include passports, state IDs, and driver’s licences.

- Your Social Security or individual tax identification number.

- The ability to authenticate your identity using a camera or a smartphone.

- Using a phone or email for multi-factor authentication.

Suggested Reading: Calculate IRS Penalties and Interest Rates

What are the Minimum Monthly Payments for IRS Payment Plans?

The monthly payment amount is generally up to you. In other words, the IRS will inquire as to your financial capacity. In contrast, if you’re on a long-term payment plan, you must select a payment amount that will eliminate your debt in 72 months.

Depending on whatever IRS payment plan you select, how you apply for the plan, and whether you are eligible for a fee reduction, the cost of the plan will vary.

If you allow the IRS to automatically deduct funds from your bank account to make the required payments and you are a low-income taxpayer, the IRS will waive the user charge.

The IRS will compensate you for the user charge after you pay off your balance if you are a low-income taxpayer who is unable to use electronic debit payments.

How to Make Changes to an IRS Payment Plan?

You can modify your monthly payment amount, monthly due date, enrol in automatic withdrawals, and resume a payment plan that has fallen behind using an online tool provided by the IRS.

- You might need to change the payment amount if your new monthly plan does not satisfy IRS criteria.

- Forms 9465 and 433-F may need to be completed if you are unable to make the required monthly payments (collection information statement).

Final Words!

Well, this is about IRS Payment Plan for 1040 Tax Return. Hopefully, the above information will helpful for you in returning 1040 tax with IRS payment plan. In case, you still need additional information or have any queries regarding IRS payment plan, connect with Team of Experts live chat by dialling Helpdesk Team.

A Frequently Asked Questions

Q. Can I Apply for an IRS Payment Plan Myself?

Ans. Yes, To apply for a payment plan, there is no fee necessary to be paid to a third party.

If you do decide to work with a tax relief organisation to assist you in paying off your debt, you might need to grant it power of attorney so that it can submit an IRS payment plan application on your behalf.

Q. What is the Partial Payment Program for Past Taxes of the IRS and How Does it Work?

Ans. The IRS provides back tax reduction schemes to assist individuals and corporations in reducing past taxes. Many individuals mistakenly think that all are eligible for back tax relief programs. The IRS offers back tax reduction plans, but they are really only available to people who can’t afford to pay their full tax burden. If you are having trouble paying your taxes, you might want to apply for one of the IRS’s back tax reduction programs, such as the Partial Payment Installment Agreement (PPIA) or the Offer in Compromise (OIC). These programs let you pay less than the amount of back taxes you owe.

Q. What are the Penalties and Interest on Back Taxes?

Ans. Knowing the penalties and interest the IRS imposes on back taxes is vital before submitting an application for any IRS back taxes resolution plan. The IRS starts charging penalties the day after taxes are not paid in full. A 5% fine is assessed for failure to file a tax return. The penalty assessed is 0.5% for failure to pay the taxes that are due. The IRS adds interest to penalties for collecting past taxes.

Interest accrues daily and is compounded on the penalty each month. The total amount due increases each month that overdue taxes are not paid in full. The sum increases significantly if not paid within a short period of time, making it even more challenging for the taxpayer to pay.