How to Fix Balance Sheet Issues Sage 50?

Undoubtedly, Sage 50 simplifies all accounting tasks of small and mid-sized businesses. But there are times when user come across several errors or bugs that can definitely appear as a barrier to the smooth running of business. A balance sheet is a document that lists all of your company’s liabilities, assets, profits, and losses. Every company needs to maintain track of its finances. The account balance at the end of the year doesn’t match, according to a Sage 50 account out of balance error. Your accounts can’t be cancelled when this error happens because your closing balances don’t match. In the below write-up, we’ll guide you how to easily tackle Balance Sheet Issues Sage 50.

Table of Contents

ToggleWhy Doesn’t my Sage Trail Balance in Sage 50?

We know that the balance sheet in Sage 50 is represented by three elements based on its mathematical formula. First, the owner’s equity must equal the sum of Liabilities minus Assets. It is known that the Sage Balance sheet does not balance if the two sides do not add up in the accounting.

What Causes Sage’s Balance Sheet to Be Out of Balance?

At the end of the year, the assets of the account balance on the balance sheet appear to be incorrect. In Sage 50, this scenario is referred to as the Balance sheet out of balance issue.

Root Causes of Balance Sheet Issues Sage 50?

There are number of reasons that could lead to Balance Sheet Issues Sage 50.

The below listed are few reasons that can help you to identify this issue:

- Erroneous transactions

- Associated custom report’s general ledger account is incomplete, incorrect, or damaged

- Balance on the account shouldn’t be zero

- Damaged custom reports

- If the account’s type has been modified

- Unbalanced subsidiary businesses

- Sorting the general ledger trail balance for certain account parts.

Common Balance Sheet Issues Sage 50

- Check out the typical issues you could encounter when using the software.

- Not all of the accounts were closed for the retained earnings account.

- The accounts balance in the income column does not match.

- The rejected receipt’s value was divided across several accounts.

- The balances for each transaction are different on the final day of the fiscal year and the first day of the new fiscal year.

How to Fix Balance Sheet Issues Sage 50?

Make sure the balance sheet for Sage 50 is current. There are a few troubleshooting you may take to help you tackle this issue.

Solution 1: Check for Reliability

- Initially, close your Sage 50 and open a new file on each of your workstations

- Following the administrative workstation closure, you should likewise shut down all other workstations

- Click on the “Change accounting period” after selecting the next Tasks option, System

- Then click on the “OK” button after selecting Period 1

- On the menu, select the “Help” menu

- After done with that, select “Integrity Check” from the menu under “Customer Service & Consultant”

- Testing of accounts and sync should be done

- Finally, we advise ensuring the ledger balance corresponds in order to assure correctness and avoid potential errors.

Need Expert Help

Are you getting Balance Sheet Issues Sage 50 and don’t know how to solve it? In that case, you must get immediate help from our Sage 50 live chat experts by dialing the ReConcileBooks helpline number at any time.

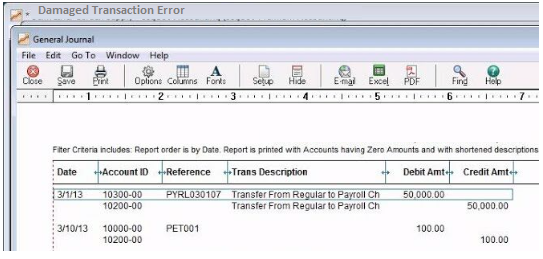

Solution 2: Verify the Damaged Transaction Error

- The very first, click on the “General Ledger” under Report >> Forms

- Select the option by clicking it in the General Ledger report

- Click on the “OK” button after making the appropriate changes to “time/date/year”

- Close the General Ledger report or error message if an error persists, then open a report or form

- Check to see if “Sage 50” has been closed by every user

- Click the “Start” button after selecting File menu and then “Data Verification”

- Once the backup is saved, the test will start immediately

- Check the account balance following the completion of the data verification process.

Perform the next troubleshooting solutions if the issue is still present.

Read more: Sage Balance Sheet Suspense Account

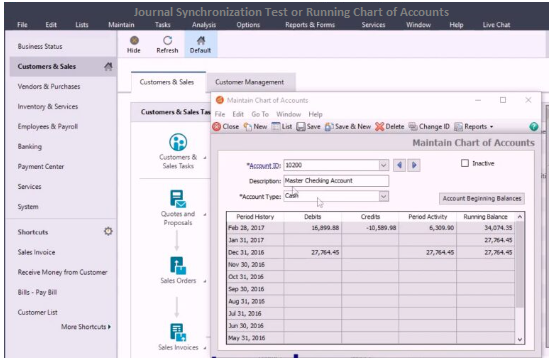

Solution 3: Fix the Error with Journal Synchronization Test or Running Chart of Accounts

- In the beginning, log out from your company file

- Next, move to the Help menu and change the accounting period

- Now, click on the Support Utilities option

- After that, click on the Integrity Check option

- Moving forward, hit the Backup button and then give a backup name

- Once done with that, choose the location where you want to save the file by hitting the Save button

- Hit “OK” within the field that says your backup file size

- From the list, you have to choose the Re-index file list

- And then click on the Chart followed by OK button

- Go to the Help menu and then select the Support Utilities option once the test completed successfully

- In the next move, you’re supposed to click on the Integrity Check

- Hit the Continue button and then give a click on the Re-index file field

- From the list, select the jrnl header and then hit the OK button

- Next step is to check the Integrity test

- Again hit the Continue button followed by choosing the Chart of Accounts field below the Data Synchronization Tests option

- Here, you have to hit the OK button

- In case, you receive any error notifications, simply click “OK”

- Open the Standard Balance Sheet after the test completed in order to verify whether it is in balance or not

- Open your General Ledger Trail Balance Sheet and then check the balance

- To determine the amount, check the General Ledger Trail amount’s debits and credits totals

- In the Help menu, select the Support Utilities tab

- Select the “Integrity check” option

- After that, select the Continue button

- Journal balances field should be selected, then hit “OK”

- Select the G/L balances field by clicking the Continue button, and then click OK

- After the test is finished, set back your accounting period.

Execute the Journal Balances Test

- Go to the Help menu and then select the Support Utilities

- Next, click on the Integrity Check followed by selecting the Continue button

- Now, select the box labelled with Journal Balances and then hit the “OK” button

- Run the G/L balances test by following the instructions below:

- Locate the Help menu and then select the Support Utilities

- Click on the Integrity Check and then hit the Continue button

- After that, click on the box named G/L Balances

- In the end, click “OK” and then verify whether report is in balance now.

Suggested Reading: Sage Balance Sheet Doesn’t Balance

Solution 4: Fix the Out of Balance Consolidated Company

- Find the subsidiary businesses

- Then select Reports & Forms

- Select General Ledger as your option

- On the General Ledger Trail Balance, double-click on the same

- Go to the bottom by scrolling down

- Verify that the debit and credits are equivalent

- In the event that it does not, use the Journal Synchronization Test to identify the problem

- If the error still exists, perform a re-consolidation of the combined company

- Verify the company’s balance in consolidation.

Solution 5: Fix the Wrong Transaction for Unbalanced Balance Sheet

Run Data Verification if the damaged transaction first occurs at the beginning of the accounting period.

- Select the File from the menu

- Click the Data Verification button

- Click Start, then select Both Tests

- Now, save the backup

- When the procedure is finished, an automatic data test will begin

- Make sure that you first revert the accounting period back to the active period if there are problems in the data verification tests

- Finally, run the General Ledger Report.

Conclusion

Checking off the Balance Sheet Issues Sage 50 is easy with the help of solution discussed above in the above write-up. However, there may be instances in which you are unable to fix such an error. In those instances, we advise you to contact our Sage 50 specialists by calling +1-347-967-4079 our dedicated Sage 50 customer Help desk, and they will provide you with the best solutions in the minimum time frame.

Frequently Asked Questions

Q. What the Steps Need to Follow to Generate Balance Sheet in Sage 50?

Ans. The below are the suggested steps, you need to perform in order to generate balance sheet in Sage 50:

- Click Company >>> Links pane >>> Financials >>> Balance Sheet to get your company’s financial information

- Select the necessary field as shown:

- Enables you to print the reportLook over your reportRecords the report’s saving

- Sends the report by email

- To create a report, click Run and then add any necessary specifications followed by choosing the accounting

- The current year’s values

- Selected time/choose period

- Selecting the Chart of Accounts

- You can make a new chart of accounts or use the default one.

Q. How are the Integrity Checks from Earlier Versions Accessible?

Ans. Making a data backup is typically a wise move before attempting any sophisticated solutions.

Earlier versions of the Integrity Check can still be accessed by following the procedures below:-

- The Sage 50 program should first be closed

- Next, right-click the Sage icon

- From the menu, select Properties right now

- Keep your cursor where it is right now in the far corner of the Target field

- In order to add, you must first enter a blank area

- When finished, press Apply before selecting the OK button

- Once you’ve updated the icon, launch the Sage 50 application

- Back up the data for the business

- Period 1 will then be used as your new accounting period

- Finally, pick Integrity Check from the drop-down box in the File section.

Q. How Can I Modify the Sage 50 Account Period?

Ans. Make a backup of the data for your business before changing the accounting periods in Sage 50:

- Select System >> Change Accounting Period from the Tasks menu, and then select the account period button in the Control Bar at the top of the main Sage 50 window

- If you do not see the option to “Change Accounting Period”, the user profile does not have safe access to the section

- With the drop-down list box, you must select the time period

- You are allowed to change this to any other period within the first one or two open fiscal years in which your accounting period was formed

- Finally, press the OK button to launch the procedure for modifying the accounting period.

Report your Issue

Latest QuickBooks Topic

- QuickBooks Desktop 2024 Download, Features and Pricing

- Traverse to QuickBooks Data Migration

- Microsoft Access to QuickBooks Data Migration

- How to Fix QuickBooks Payroll Update Error 15243?

- How to Fix QuickBooks Error Code 12057?

- Maxwell to QuickBooks Data Migration

- Master Builder to QuickBooks Data Migration

- How to Fix QuickBooks Error Code 15223?

Accounting Issue and Problem

- SAGE 50 2022 Canada Download

- Installing SAGE 50 on Windows 11

- QuickBooks Payroll Item List Does Not Appear

- QuickBooks Firewall Blocking

- How to Email QuickBooks File

- Why QuickBooks Slow

- Why QuickBooks Freezing

- QBWC1085

- QuickBooks Scan Manager

- QuickBooks Payroll Liabilities Not Showing

- QuickBooks Unable to Send Emails Due to Network Connection Failure

- QuickBooks Utility Application

- QuickBooks Unable to Save

- How to UnFreeze QuickBooks

Search by Categories