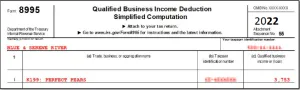

Qualified business income deduction (QBID), which allows pass-through business owners to write off up to 20% of their share of qualified business income, can be claimed by qualified small business owners by submitting IRS tax Form 8995.

You’ve come to the perfect place if you’re a small business owner ready to use IRS Form 8995 to reduce your tax burden. This tutorial will cover all you need to know about Form 8995, such as its function, who qualifies, and how it differs from the related but more intricate Form 8995-A.

What is IRS Form 8995?

Owners of pass-through businesses, such as sole proprietorships, partnerships, LLCs, or S corporations, must file IRS Form 8995 in order to claim the qualifying business income (QBI) deduction, also known as the pass-through or Section 199A deduction.

After the 14% corporate tax rate was lowered as part of the Tax Cuts and Jobs Act (TCJA) in 2017, the QBI deduction was created. Sadly, this tax cut only resulted in savings for C-corporations, which account for 5% of small firms. Other small companies, such sole proprietorships and LLCs, did not gain anything from the TCJA. Legislators created QBID in reaction to the fact that C-corporations are the only commercial entities that can benefit from tax reductions.

Now, if you run a pass-through company and made $150,000 in qualified business income as a sole proprietor in 2022, your taxable business income for that year would be $120,000 because the QBI deduction allows you to lower your taxable income by 20%.

Suggested Reading: Tax Form 2441

The QBI deduction is available if you file Form 1040 (Individual Income Tax Return) and are self-employed or the owner of a small business. You must complete IRS Form 8995 or Form 8995-A in order to compute and honour this deduction.

- Form 8995: For the most part, taxpayers claiming the QBI deduction just need to complete Form 8995, a one-page document that is rather straightforward.

- Form 8995-A: A smaller number of people with higher incomes are required to complete Form 8995-A, an enlarged and more complicated form of Form 8995. Use of this form necessitates the completion of four extremely extensive sections and schedules, in addition to the information needed for Form 8995.

Who and all Can Use IRS Form 8995?

You must fulfill a few requirements in order to be eligible for QBI deduction. These requirements mostly concentrate on how the business is structured and how much money it makes.

Business Structure Qualifications

To be eligible for the QBI deduction, individuals must possess at least one of the following pass-through business structures:-

- Partnerships

- S corporations

- Sole proprietorships

- Limited liability companies (LLCs)

- Cooperative engaged in agriculture or horticulture (must use Form 8995-A)

- Estates and trusts.

Income Type Qualifications

On Form 8995, only a few types of income are permitted.

They comprise taxable earnings from:-

- Qualified dividends on REITs (REIT stands for real estate investment trust)

- Rental real estate

- Pass-through business income

- Qualified PTP earnings/income or losses (PTP stands for publicly traded partnership)

If you have any specific query, also get in touch with the experts of live chat helpdesk.

Income Threshold

The income requirement must be met in order for owners of pass-through business entities to qualify for the QBI deduction.

The QBID eligibility income level for 2022—The tax year for which you are now filing—is $340,100 for married couples filing jointly or $170,050 for all other filing statuses.

For married individuals filing jointly in 2023, the barrier rises to $364,200; for those filing separately, it falls to $182,100; and for heads of household who operate a pass-through business, it rises to $364,200.

You most likely qualify for the entire deduction if you meet the requirements for the QBID business structure and your taxable business income is less than the cap established for your filing status.

If your taxable business income is below the cap imposed for your filing status and you satisfy the QBID business structure requirements, you probably qualify for the entire deduction.

There are other requirements the Federal Revenue Service sets to help assess whether the QBI deduction may qualify you for a partial deduction if your income exceeds the threshold, so you are not immediately ineligible for the deduction if your income exceeds the limit.

Suggested Reading: Form 8938 and FBAR

The deduction benefit phases out if your taxable income in 2022 exceeds $220,050 for single filers, $440,100 for married couples filing jointly, or $44,100 for all other filing statuses. The deduction benefit fades out if your 2023 taxable income is $464,200 for married couples filing jointly and $232,100 for individuals filing separately.

Warning: In order to be eligible for the QBI deduction, your work must fall within one of the listed service trades and your salary must be below the income threshold. Examples of such occupations include lawyer, accountant, performer, and doctor.

You can still be qualified even if your salary is higher than the cutoff and you don’t work in a profession that isn’t allowed to use the deduction. Using Form 8995-A is all that is required.

Income Streams that are Not Eligible for the QBI Deduction

You should take into account that some forms of income are not eligible for the pass-through deduction when figuring your deduction.

Some of these income sources are as follows:-

- Interest income unrelated to a business

- Annuities not related to your business

- Capital gains or losses or dividends

- Wage income

- Profit, loss, or deductions from contracts with hypothetical principals

- Gains or losses in foreign markets

- Income not generated by a U.S.-run business

Important Considerations When Filing IRS Form 8995

The IRS is reevaluating how it determines the legitimacy of QBI deductions in 2022 as a result of unconfirmed and potentially incorrect deduction claims made by people looking to take advantage of the system. In light of the foregoing, be on the lookout for more detailed deduction restrictions in the upcoming year.

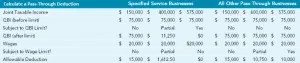

How to Calculate a Pass-Through Deduction?

- You must first determine your actual Qualified Business Income in order to compute your Pass-Through Deduction (QBI).

The IRS defines QBI as follows:-

The net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business, including income from partnerships, S corporations, sole proprietorships, and specific trusts. This typically includes, but is not limited to, the self-employment tax deduction portion, deductions for self-employed health insurance, and deductions for contributions to qualifying retirement plans (e.g. SEP, SIMPLE and qualified plan deductions).

- The next step is to calculate the pass-through deduction for business owners whose income is below the threshold by multiplying their QBI by 20%. In order to prevent pass-through corporations from taking advantage of this deduction, the IRS has also listed a number of things that are not eligible for QBI.

The following things shouldn’t be included in your QBI calculation, while this is not an exhaustive list:-

- Investment items such as capital gains or losses or dividends

- Income that is not directly related to doing business in the United States

- Items that should not be included in taxable income

- Wage income

- Specific dividends and substitute payments for dividends

- Not appropriately attributed to a trade or business is interest income

- Transactions involving commodities or gains or losses in foreign currencies

- Unless they are acquired in conjunction with the trade or business, annuities

- Amounts that you receive from a partnership as guaranteed payments

- Amounts that an S corporation paid out as fair compensation

- Qualified REIT dividends

- Payments made to a partner for work performed outside of their partnership

- PTP income

What’s a Loss Carry-Forward?

Small companies don’t always succeed financially in the real world. Furthermore, a lot of businesses experience losses every year. The question of how these losses effect QBIT deductions naturally arises.

It depends, again again. In specifically, the IRS treats losses differently depending on whether you own any other pass-through businesses.

To get the best assistance regarding the IRS Form 8995, you can simply dial +1-347-967-4079 to contact our Specialists Team.

Having several qualifying businesses under one ownership:-

“The taxpayer is required to net their QBI from several trades or firms, including losses (including aggregated trades or businesses). As a result, qualified business losses from one business will be offset by qualified business income (QBI) from other businesses (including combined enterprises) in proportion to the net income of the businesses with QBI.”

So, what if you don’t have another company to offset your losses against?

“The carried-forward negative QBI will be taken into account as emanating from a separate trade or business for computing the QBI Component in the subsequent taxable year.”

In other words, a loss never truly disappears. The IRS instead permits businesses to roll QBI losses over to succeeding years.

Conclusion

Small business owners can save a tonne of money by taking advantage of the Qualified Business Income Tax deduction. But, completing IRS Form 8995 can be incredibly challenging. Don’t allow the difficulty of completing this form deter you from taking advantage of these fantastic tax advantages. If you have more doubts or concerns, you can reach out to the Team of Experts by dialing Customer Helpdesk.

Frequently Asked Questions

Q. Can I Use the Pass-Through Deduction for My Side Business?

Ans. It is quite likely that you are eligible for the QBI deduction if your side business is set up as a sole proprietorship, partnership, LLC, or other pass-through corporation and you are required to pay self-employment tax.

After deducting business expenditures, your take-home pay as an Uber or Lyft driver would be $8,000, and you could deduct 20% of that amount, or $1,600. You gain $6,400 if you take $1,600 out of $8,000 total. Thus, $6,400 after the pass-through deduction is your taxable company income.

The deduction only applies to income earned by businesses, so keep that in mind. It is true that you can deduct up to 20% of your side hustle revenue from your taxable company income, but this does not entitle you to a 20% deduction from your total taxable income.

Q. What’s New in the IRS Form 8995?

Ans. There are 3 new things added in IRS Form 8995:-

- Filing status name changed to qualifying surviving spouse: Qualifying surviving spouse is the new name for the filing status qualifying widow(er). The filing status regulations have not changed. The requirements for qualified surviving widow(er) and qualifying surviving spouse are the same.

- Taxable income limitation adjustments: Limitations on taxable income are raised and inflation-adjusted. For the 2022 tax year, the combined married filing separately and single income limitation amounts are equal.

- A method to track losses or deductions suspended by other provisions: The addition of a worksheet offers a practical way to keep track of and calculate any losses or deductions that were previously disallowed so that they can be taken into account when figuring your eligible business income deduction for the applicable year. For the 2022 suspended and allowed losses, a new row has been added.

Q. How is the QBI Deduction Calculated?

Ans. Usually, your QBI deduction is the lesser of these two amounts:-

- 20% of your QBI + 20% of your REIT dividends and PTP income.

- 20% of your taxable income, less net capital gains.

That should be all you need to know if you’re a standard freelancer, independent contractor, or small business owner.

On the other hand, perhaps your situation is more difficult. For example, whether you have a large income from self-employment or you work in a particular field, such as law or medicine. In that instance, there will be restrictions on how much QBI you can claim.