Change the Financial Year Start Date in Sage

Home » Sage 50 » Change the Financial Year Start Date in Sage

The accounting and company management software system Sage 50, originally known as Simply Accounting. You can alter the start date of your fiscal year with Sage 50, among a host of other software operations. During your first fiscal year, you can easily alter the start date. The next step is to update the fiscal year end date, which will immediately move the new fiscal year start date to the next day. However, users might need to do this if they have entered incorrect financial year end date or financial year has changed. They can change the year end data at any time. This article explains how to change the financial year start date in Sage.

Table of Contents

ToggleHow Does it Work?

If your financial year has changed and you need to shorten your financial year, you must adjust the start date back to reflect the new end date in Sage 50 Accounts, which only supports 12-month financial years.

| Year | 22 | 22 | 22 | 22 | 22 | 22 | 22 | 22 | 22 | 22 | 22 | 22 | 23 | 23 | 23 |

| Month | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar |

| Current | Start | End | |||||||||||||

| New | Start* | End |

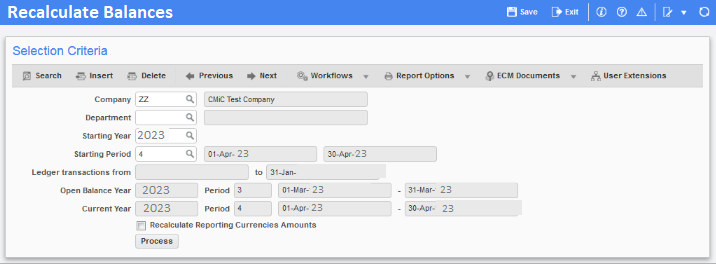

How are the Balances Recalculated?

The following adjustments take place when you use the Financial Year option to modify the beginning of your financial year:

- Based on the transactions that show up on your audit trail, the monthly nominal code balances are rebuilt.

- Based on the transactions in your audit trail, the year-to-date turnover figures for your customers and suppliers are updated.

- The product transactions are used to adjust the monthly sales amounts on the product records.

Note: –

All budget and prior year values are eliminated from the nominal codes when the Financial Year Change option is used. You cannot create Budget or Prior Year reports without this data. It is possible to save this information, though, for conventional budgeting and prior year values.

To get the best assistance regarding the Change the Financial Year Start Date in Sage, you can simply contact our Sage 50 live chat specialists Team.

Run the Reports for the End of the Shortened Financial Year

Set the financial year to January 2022 if you want the new fiscal year to begin in that month.

For instance, running the typical year-end reports as of the end of December 2022 would be necessary if the new, shortened financial year began in January 2023.

Typical reports include:

- Profit & loss

- Aged debtors

- Trial balance

- Balance sheet

- Aged creditors

Change the Financial Year Start Date in Sage

The prior year must be selected when changing the financial year start date.

For instance, configure the financial year to begin in January 2022 if you want the new fiscal year to begin in January 2023.

- In the beginning, go to the Settings >>> Financial Year and then click on the “Change” tab

- When prompted to review data and create backups, click on the “Yes” button

- In response to the question about nominal historical data, select the “Yes”

- The required financial year’s start month and year should be set

For example, configure the financial year to begin in January 2022 if you want the new fiscal year to begin in January 2023

- At last, click on the “Ok” button >>> “Yes” and then again hit the Ok button twice.

Run the Year End

By doing this, the profit and loss figures are adjusted to include the year’s end date and the financial year’s start date is moved up to the needed start date.

Suggested Reading: Sage 50 Balance Sheet Period vs Year to Date

Advancement of the Financial Year’s Start Date to the Required Start Date

- Select “Year End” from the menu under Tools >> Period End

- After that, click on the “Check Data” option to see if there are any data mistakes, correct them, and then click on the “Close” button

- Then select “Ok” after selecting the “Check COA” option

- Moving forward, click on the “Backup” option, followed by “Ok” and “Ok” once again

- If you want to save a copy of your data as an archive, keep the Archive checkbox selected

- Choose the budget option after selecting the Budgets checkbox to create budgets for the new fiscal year

- Make sure the date is in the year you are closing

- If necessary, enter a lock date

- Click “Run Year End” after selecting the “Yes” button and then click the “Ok” tab

- Finally, choose how you wish to output the report before clicking “Ok” twice.

Suggested Reading: Report Profit and Loss on Schedule C

After Running Year End

There are three simple things must be checked to ensure that your data is all set for your new financial year:

- Check the Financial Year Start Date

- Click Financial Year under Settings in the navigation bar

- Verify the accuracy of the date

- Before moving on, you must Reverse the Year End to make the necessary corrections.

- Check the Brought Forward Trail Balance

By default, your profit and loss nominal numbers range from 4000 to 9999. As part of the year-end procedure, the balance is transferred to your retained profit balance sheet code, which is 3200.

- Click Trial Balance after selecting Nominal codes

- On the Period drop-down selection, select Brought forward and then click Preview >>> Run

- After clicking on the “Ok” button, make sure your profit and loss nominal codes are no balances.

You should examine your chart of accounts (COA), run the year end once more, and restore your pre-year end backup if any of the profit and loss codes contain balances.

- Make sure that your data is healthy

- On the menu bar, select the File menu >>> Maintenance, and then click on the “Check Data” option

- Next, hit “Ok” when the notification stating that there are no issues displays

- The Year End process was unsuccessful if you now have problems in your data

- Run the year end again after restoring to the last backup you made.

Congratulations! Your year end is complete, and you’re prepared to begin working in your new fiscal year in Sage.

Conclusion

We hoped the discussion above would be helpful in assisting you in Change the Financial Year Start Date in Sage. Simply follow the steps in order. You can consult our specialists by dialing Sage 50 Helpdesk Team if you run into any problems doing the aforementioned tasks. Our Team is very knowledgeable, and we will be able to offer every solution to resolve the Sage 50 software-related problems.

FAQs: Change the Financial Year Start Date in Sage 50

Q. What Occurs When you Start a New Fiscal Year in Sage 50?

Ans. When you create a new fiscal year in Sage 50, the following modifications will appear:

- For the new fiscal year, dates are automatically set up.

- The spending and revenue accounts’ balances will both be zeroed out.

- The Retained Earnings Account receives the Net Profit or Loss.

- Both the asset and liability accounts’ balances are carried over to the new fiscal. This balance is not, however, transferred to an other account.

Q. When Do We Lock the Previous Financial Year in Sage 50?

Ans. You will need to Lockdown the date if you need to stop transactions from being entered for the prior year. For example, if your fiscal year ends on December 31, you must specify that date as your END LOCKDOWN date. The new transactions can only now be accepted starting on January 1.

You will need to remove the YEAR-END LOCKDOWN date if you need to input some transactions for the prior year.

Q. What are the Things Need to be Checked Before I Change the Year Start Date in Sage 50?

Ans. The following are a few things you should look at before the financial year ends in Sage:

- Ensure that any outstanding transactions, including adjustments from the accountant, have been properly posted.

- You need to act now if you plan to run at the end of the month.

It is necessary to print copies of the management reports, such as the balance sheet and the profit and loss statement.

Report your Issue

Latest QuickBooks Topic

- QuickBooks Desktop 2024 Download, Features and Pricing

- Traverse to QuickBooks Data Migration

- Microsoft Access to QuickBooks Data Migration

- How to Fix QuickBooks Payroll Update Error 15243?

- How to Fix QuickBooks Error Code 12057?

- Maxwell to QuickBooks Data Migration

- Master Builder to QuickBooks Data Migration

- How to Fix QuickBooks Error Code 15223?

Accounting Issue and Problem

- SAGE 50 2022 Canada Download

- Installing SAGE 50 on Windows 11

- QuickBooks Payroll Item List Does Not Appear

- QuickBooks Firewall Blocking

- How to Email QuickBooks File

- Why QuickBooks Slow

- Why QuickBooks Freezing

- QBWC1085

- QuickBooks Scan Manager

- QuickBooks Payroll Liabilities Not Showing

- QuickBooks Unable to Send Emails Due to Network Connection Failure

- QuickBooks Utility Application

- QuickBooks Unable to Save

- How to UnFreeze QuickBooks