Calculate Tax Depreciation Home Office Deduction

Home » Tax » Calculate Tax Depreciation Home Office Deduction

One of the most challenging parts of the complete home office deduction factor is tax depreciation. When it comes to reducing the tax bill, it can, however, be incredibly valuable. It is regarded as one of the best tax benefits of working from home. Calculate Tax Depreciation Home Office Deduction costs the normal wear and tear on the specific area of your home that you have been using for business should be increased by a dollar amount.

The calculation may appear to be extremely hectic, but you only need to go through the challenging part once; after that, it is incredibly simple. In this article, we’ll walk you through the complete details on “Calculate Tax Depreciation Home Office Deduction”.

Table of Contents

ToggleRules for Claiming Office Expenses

One major advantage of being self-employed is the ability to deduct expenses for a home office. As long as you follow a few guidelines, you can turn a portion of your personal expenditures into a tax-deductible business expense.

- After subtracting other work-related expenses, you are only permitted to deduct your net company profit. If your office expenses come to $3,000 but you only earned $2,000, for instance, you’re only allowed a $2,000 deduction. You can carry over any unused home office deduction amounts to the subsequent tax year, ensuring that they are not gone.

- You must only conduct work in your office space. If it also functions as your family’s TV area, it is not considered to be your “office.” This is referred to as “regular and exclusive use” by the Internal Revenue Service.

- Your primary location of business must be your office. In other terms, that’s where you conduct business for your freelance business. However, this does not inherently imply that you cannot serve clients in other locations. Simply run your company from your home office rather than from anywhere else.

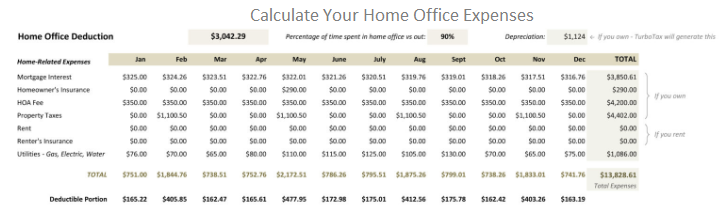

Calculate Your Home Office Expenses

The federal Form 8829, “Expenses for Business Use of Your Home,” can be used to submit the home office deduction. On your individual Form 1040, you must also submit Schedule C, “Profit or Loss from Your Business,” along with this form.

Suggested Reading: Calculate IRS Penalties and Interest Rate

You must first calculate the proportion of your overall expenses that are allocated to your company.

There are two methods to figure out this percentage:

- Percentage of square feet: Measure the size of your house overall and the size of your home office. Your home office proportion will be calculated as the ratio of the two. If your workplace occupies 20% of your home’s overall space, you may deduct 20% of those costs.

- Number of rooms: Count the spaces in your house. One divided by the total number of rooms in your house will be your home office percentage.

Note: If you employ the second method, every area in your house must be roughly the same size.

Allowable Home Expenses

Rent, mortgage interest (but not the principal portion of your mortgage payments), property tax, renters or homeowner’s insurance, homeowners association dues, utilities, and repairs are all considered allowable home office costs. Each of these costs would be subject to your percentage rate, which you would then add up to determine your tax refund.

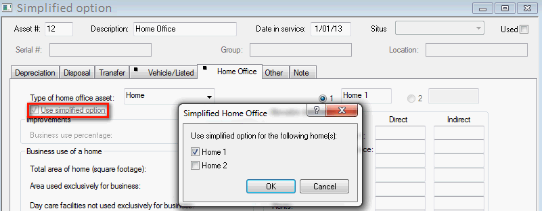

Simplified Option

Beginning with the 2013 tax year, the IRS introduced a second, much more straightforward way of calculating your home office deduction. The “Simplified Option,” as its name implies, comes out to $5 per square foot of your home’s business or office space. Sadly, it is limited to 300 square feet. If your workspace is smaller than this, it may save you a lot of time-consuming record-keeping, but otherwise, you risk restricting the amount of your deduction.

Important Note: You may want to perform quick calculations on both methods, once using the regular method and again using the simplified method, to determine which yields the largest deduction and makes the most sense to you.

Deducting your Business Assets: Depreciation

If you own your home, you may be able to deduct a portion of the cost of your house through depreciation. However, you cannot deduct any part of the principal portion of your mortgage payments. Any repairs done specifically to your office space are also deductible.

Note: A depreciation you take on the home will unfortunately result in taxable gains through depreciation recapture when and if you ever decide to sell it.

Business investments may also be depreciated. A business asset is any item you use to generate revenue that has a longer-than-one-year useful life. The use of computers, software, and office supplies are all suitable instances.

There are two ways you can pay for these purchases:

- In the year that you acquire the asset, you may deduct the entire cost of the purchase.

- The price of the acquisition can be spread out over several years.

Both strategies require that you enter your expenditure information on Form 4562, Depreciation and Amortisation. If you want to take the entire deduction in the year of purchase, it is known as a Section 179 deduction and is computed in Part 1 of Form 4562. If you choose to spread out the expense over several years, you are “depreciating” your property.

Conclusion

Get a better grip on this particular topic “Calculate Tax Depreciation Home Office Deduction” by going through this segment with full concentration. Or connect with our tech personnel right away using our dedicated Customer Helpdesk. Our tech geeks will ensure to provide you with the right set of steps to Calculate Tax Depreciation Home Office Deduction successfully. If you have any specific query, also get in touch with the experts of LIVE CHAT.

Frequently Asked Questions

Q. Should you Use Section 179 or Depreciation of your Assets?

Ans. Due to the fact that the complete cost is claimed at once, Section 179 typically yields the highest deduction. This lowers both your income tax and your self-employment tax. However, there is a benefit to spreading out the expense over several years. This can lower your self-employment tax and income tax in lesser amounts over time. You can also defer some of the cost to years when you might need the deduction more.

Q. What Occurs Post-House Sale?

Ans. One of the main issues with the depreciation expense deduction is that it contains the specific tax hit that will occur when the house is sold. Although there may be many worries, they will be considerably fewer than the deductions you have included.

This is where it matters. Any implicit depreciation on your specific home transforms into a taxable gain when the home is sold. It results from a Depreciation Recapture idea used by the IRS.

Even if you choose not to accept the depreciation cost and instead choose the full office deduction, a tax problem will still arise. Instead, it relies on the possible depreciation expense you could have incurred.

Q. What Exactly are Business Assets?

Ans. When used to generate revenue, a piece of property with a longer-than-year-long useful life is referred to as a business asset. Computers, software, and office furniture are good examples. The principal portion of your mortgage payments cannot be partially deducted; however, if you own your house, you may be able to deduct a portion of the purchase price.

Latest QuickBooks Topic

- QuickBooks Desktop 2024 Download, Features and Pricing

- Traverse to QuickBooks Data Migration

- Microsoft Access to QuickBooks Data Migration

- How to Fix QuickBooks Payroll Update Error 15243?

- How to Fix QuickBooks Error Code 12057?

- Maxwell to QuickBooks Data Migration

- Master Builder to QuickBooks Data Migration

- How to Fix QuickBooks Error Code 15223?

Accounting Issue and Problem

- SAGE 50 2022 Canada Download

- Installing SAGE 50 on Windows 11

- QuickBooks Payroll Item List Does Not Appear

- QuickBooks Firewall Blocking

- How to Email QuickBooks File

- Why QuickBooks Slow

- Why QuickBooks Freezing

- QBWC1085

- QuickBooks Scan Manager

- QuickBooks Payroll Liabilities Not Showing

- QuickBooks Unable to Send Emails Due to Network Connection Failure

- QuickBooks Utility Application

- QuickBooks Unable to Save

- How to UnFreeze QuickBooks

Search by Categories